The disadvantages of a special needs trust can create unexpected challenges for families seeking to provide long-term financial security for loved ones with disabilities. Managing restrictions on how funds can be used and potential loss of government benefits are key concerns. Careful consideration is essential when deciding whether a special needs trust is the right choice for your unique situation. Understanding the drawbacks and planning accordingly can help ensure the trust serves its intended purpose effectively.

What Are the Disadvantages of a Special Needs Trust?

A special needs trust can be a valuable tool in providing financial security for individuals with disabilities while preserving their eligibility for government benefits. However, like any legal arrangement, there are some disadvantages to consider when setting up a special needs trust. In this article, we will delve into the potential drawbacks of special needs trusts and how to navigate them.

1. Complexity of Setting Up

One of the main disadvantages of a special needs trust is the complexity involved in setting it up. Creating a trust requires careful consideration of various factors, including the individual’s specific needs, the type of assets involved, and the legal requirements of the trust. This complexity can be overwhelming for families who are already dealing with the challenges of caring for a loved one with special needs.

Additionally, the legal documentation and ongoing maintenance of a special needs trust can be time-consuming and may require the assistance of legal professionals. This can result in additional expenses for the family, adding to the financial burden of setting up and managing the trust.

2. Limitations on Asset Use

Another disadvantage of a special needs trust is the restrictions placed on how the trust funds can be used. The primary purpose of a special needs trust is to supplement the government benefits received by individuals with disabilities without jeopardizing their eligibility for assistance programs such as Medicaid and Supplemental Security Income (SSI).

As a result, the trust funds cannot be used for certain expenses that are considered basic necessities, such as food, shelter, and clothing. This limitation can be frustrating for families who may wish to use the trust funds for a wider range of expenses to improve their loved one’s quality of life.

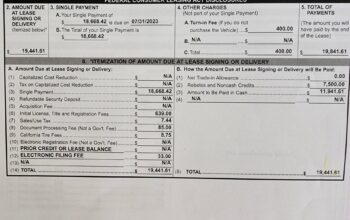

3. Costs and Fees

Setting up and managing a special needs trust can also come with significant costs and fees. Legal fees for creating the trust document, ongoing administrative fees, and fees for investment management can all add up over time. These expenses can eat into the funds available in the trust and reduce the amount ultimately available to benefit the individual with special needs.

Furthermore, certain types of trusts, such as pooled trusts, may charge additional fees or have minimum deposit requirements that can be prohibitive for some families. Understanding the full extent of the costs associated with a special needs trust is essential for families to make informed decisions about whether this type of arrangement is the right choice for their circumstances.

4. Lack of Flexibility

Special needs trusts are designed to provide long-term financial support for individuals with disabilities. While this can be advantageous in ensuring continued assistance for the beneficiary, it also means that the funds in the trust may not be easily accessible for unexpected or urgent needs.

Unlike other types of assets, such as savings accounts or investments, the funds in a special needs trust are typically subject to strict guidelines regarding their use. This lack of flexibility can be frustrating for families who may need to access the funds quickly in response to unforeseen circumstances.

5. Inheritance and Residual Funds

One of the potential drawbacks of a special needs trust is what happens to the remaining trust funds after the beneficiary passes away. Depending on the type of trust and its specific provisions, any remaining funds may be required to be used to reimburse Medicaid for benefits provided during the beneficiary’s lifetime.

This can reduce the amount of money available to pass on as inheritance to other family members or loved ones. Understanding the rules and regulations governing the distribution of residual funds from a special needs trust is crucial for families to make informed decisions about how best to plan for the future.

While special needs trusts can be a valuable tool in ensuring financial security for individuals with disabilities, it is essential to consider the potential disadvantages before setting one up. From the complexity of establishing the trust to the limitations on asset use and the costs involved, there are various factors to weigh when deciding if a special needs trust is the right choice for your family.

By understanding the drawbacks of special needs trusts and seeking guidance from legal and financial professionals, families can make informed decisions about how best to provide for their loved ones with disabilities while protecting their eligibility for vital government benefits.

Ultimately, the key is to carefully evaluate your unique circumstances and goals to determine whether a special needs trust is the most suitable option for meeting your family’s long-term financial needs.

Special Needs Trust Restrictions – What you need to know!

Frequently Asked Questions

What implications should one consider before setting up a special needs trust?

Before establishing a special needs trust, it is crucial to understand some disadvantages that come with it. One of the primary considerations is the potential loss of government benefits. If not structured correctly, the trust assets could affect the beneficiary’s eligibility for means-tested programs like Medicaid or Supplemental Security Income (SSI).

How does control over the trust funds pose challenges in a special needs trust?

Another issue with special needs trusts is the restriction on the beneficiary’s control over the funds. Since the trustee manages the assets, the beneficiary cannot directly access or manage the money. This lack of control may lead to frustration or hinder the individual’s ability to make personal financial decisions.

What are the tax implications associated with a special needs trust?

Taxation can be a significant concern with special needs trusts. Depending on how the trust is set up, the income generated within the trust may be subject to income tax at a high rate. Additionally, the trust may face estate tax implications upon the beneficiary’s passing, potentially reducing the overall value of the assets intended for the beneficiary.

Final Thoughts

In conclusion, the disadvantages of a special needs trust are significant. The strict rules and regulations governing these trusts can limit flexibility for beneficiaries. Additionally, setting up and managing a special needs trust can be costly and time-consuming. Understanding these drawbacks is crucial for making informed decisions about utilizing a special needs trust for the financial security of individuals with disabilities.